“You wouldn’t ignore your pension contributions in your 20s…so why ignore your health ones?”

In the UK, auto-enrolment pensions are now second nature. Quiet, consistent contributions build security over decades. But when it comes to our health’s future, most people, and most organisations, are still playing short-term.

For HR and employee benefits leaders, that’s a strategic blind spot. International Youth Day is a reminder that early health investment delivers the highest returns, and the workplace is one of the most powerful vehicles for making it happen!

Why Young Employees Are Your Prime Investment Window

Health behaves a lot like compound interest: the earlier you start, the greater the lifetime gain.

Our 20s and early 30s are a physiological sweet spot: bone density peaks, cardiovascular resilience is built, and posture and activity habits become ingrained. The Association for Young People’s Health calls this the “triple dividend”: better wellbeing now, improved health in adulthood, and benefits for the next generation.

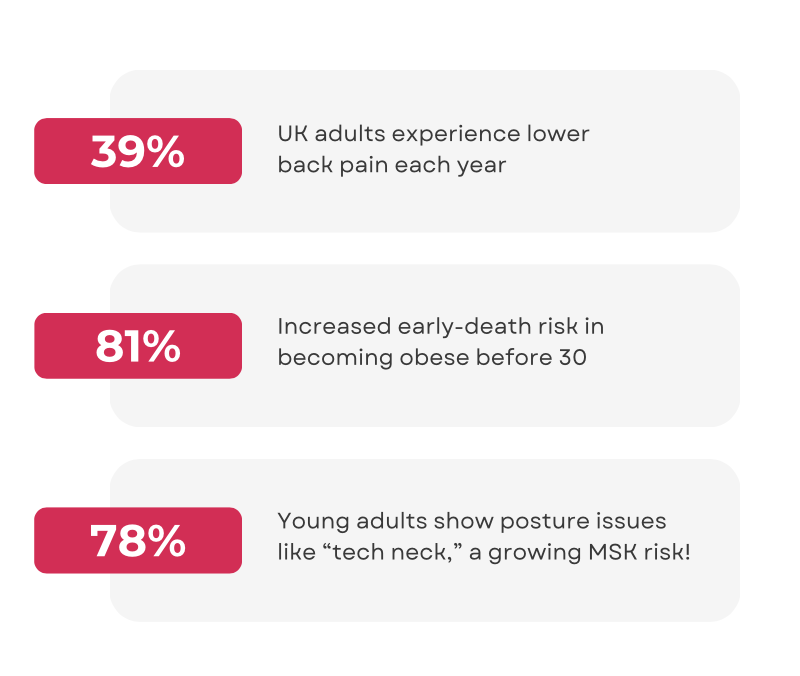

But the reverse is just as true: early neglect compounds. Consider:

The Organisational Cost of Waiting

From an employer’s perspective, these aren’t distant hypotheticals: they’re early warning signs. Musculoskeletal (MSK) disorders and mental health conditions are consistently among the top drivers of workplace absence.

In 2023, 13.9% of all deaths in England (>75,000 lives) were deemed preventable through earlier intervention. In a business context, that translates into:

- Prolonged sickness absence and costly presenteeism

- Rising healthcare and insurance claims

- Declining productivity across teams

- Talent attrition, as younger workers gravitate towards employers who actively invest in their wellbeing

For HR, the ROI isn’t purely financial. A benefits strategy that visibly prioritises prevention signals to younger employees that they are valued as people, not just headcount. It builds loyalty, strengthens employer brand, and supports long-term retention in a competitive market.

From Pension to ‘Health Pension’

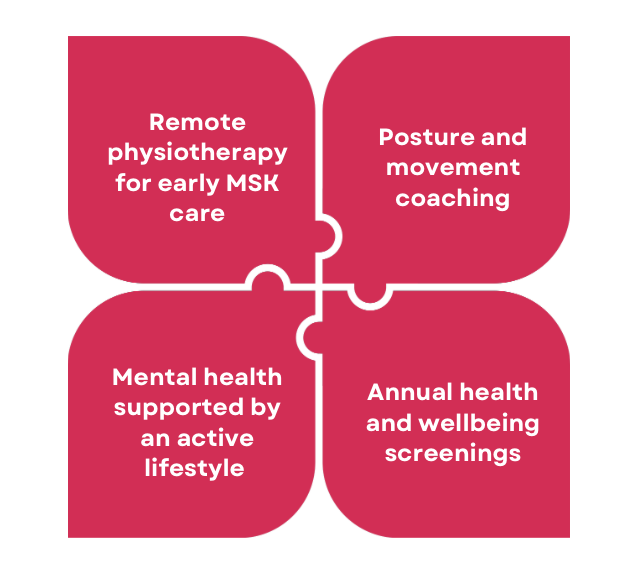

We’ve already proven that auto-enrolment can transform financial planning. So why not apply the same model to health? Imagine every new hire, especially in their 20s and 30s, being automatically enrolled into a ‘health pension’ programme:

These aren’t “perks.” They’re strategic investments with measurable returns, for the individual and the business.

How DocHQ Can Help

At DocHQ, we work with HR and benefits teams to make preventative health not just accessible, but effortless. Our Remote Physio and wellbeing solutions address MSK issues before they escalate, support mental health resilience, and help younger employees build the daily habits that will protect their health for decades.

Because just like a pension, the earlier you start, the bigger the payoff!

References

https://ayph.org.uk/reasons-to-invest-in-the-health-of-10-24-year-olds/

https://www.kingsfund.org.uk/insight-and-analysis/long-reads/what-is-prevention-in-health